The Estate Planning Attorney PDFs

Table of ContentsExamine This Report on Estate Planning AttorneySome Known Details About Estate Planning Attorney How Estate Planning Attorney can Save You Time, Stress, and Money.What Does Estate Planning Attorney Mean?The Definitive Guide for Estate Planning Attorney

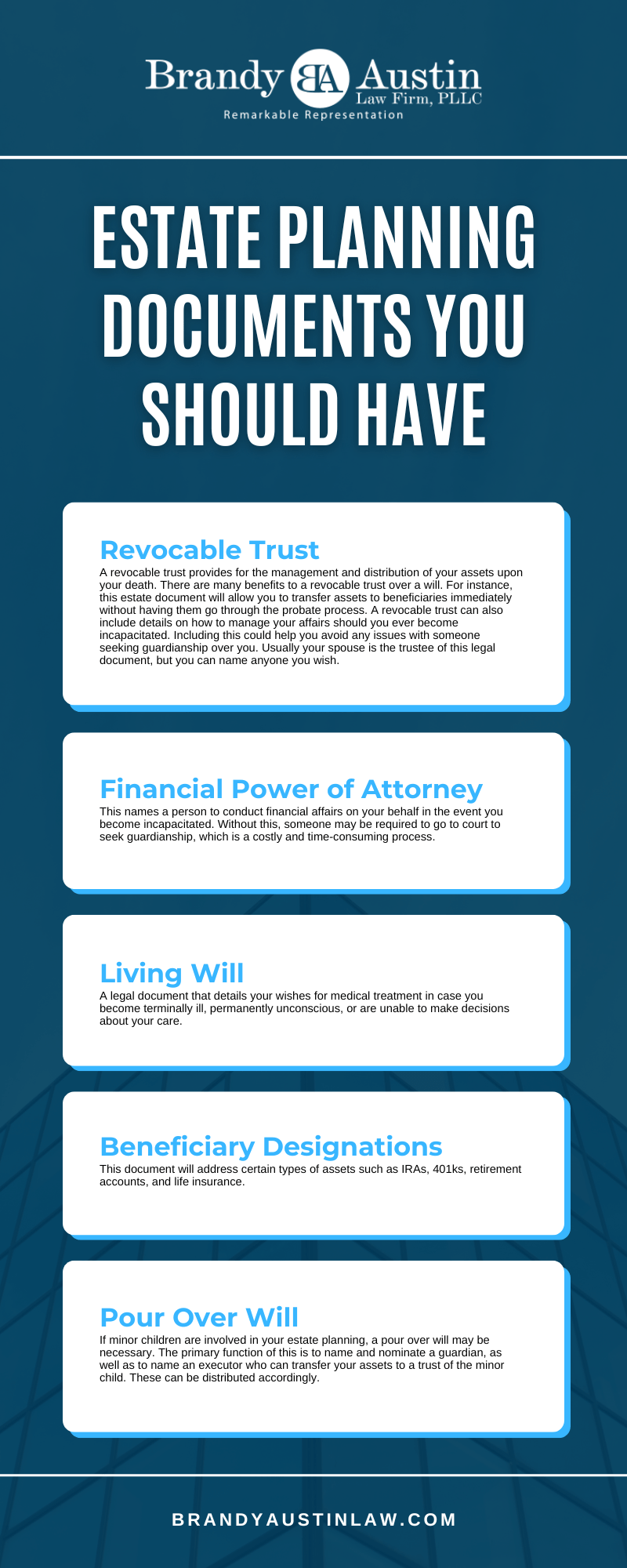

Encountering end-of-life decisions and protecting household wide range is a challenging experience for all. In these tough times, estate preparation lawyers aid people prepare for the circulation of their estate and establish a will, trust, and power of attorney. Estate Planning Attorney. These attorneys, also described as estate law lawyers or probate attorneys are qualified, knowledgeable experts with a thorough understanding of the federal and state legislations that relate to how estates are inventoried, valued, dispersed, and taxed after fatality

The intent of estate planning is to correctly prepare for the future while you're audio and qualified. An appropriately prepared estate plan outlines your last wishes precisely as you want them, in one of the most tax-advantageous fashion, to prevent any questions, false impressions, misunderstandings, or conflicts after fatality. Estate planning is an expertise in the lawful profession.

Some Known Questions About Estate Planning Attorney.

These lawyers have an in-depth understanding of the state and federal regulations associated with wills and trust funds and the probate procedure. The obligations and responsibilities of the estate attorney may include therapy customers and composing legal files for living wills, living counts on, estate plans, and inheritance tax. If needed, an estate preparation attorney might join litigation in court of probate on part of their customers.

, the employment of attorneys is expected to expand 9% between 2020 and 2030. Regarding 46,000 openings for attorneys are projected each year, on standard, over the years. The path to coming to be an estate planning lawyer is similar to other method areas.

Ideally, take into consideration possibilities to acquire real-world work experience with mentorships or internships associated with estate preparation. Doing so will provide you the abilities and experience to make admission into regulation school and network with others. The Law Institution Admissions Test, or LSAT, is a necessary part of applying to law institution.

It's important to prepare for the LSAT. Most legislation students use read review for law school during the autumn term of the final year of their undergraduate studies.

Estate Planning Attorney Fundamentals Explained

Generally, the yearly income for an estate lawyer in the united state is $97,498. Estate Planning Attorney. On the high-end, an estate preparation attorney's wage might be $153,000, according to ZipRecruiter. The price quotes from Glassdoor are similar. Estate planning attorneys can operate at large or mid-sized law practice or branch out by themselves with a solo technique.

This code connects to the restrictions and rules troubled wills, trust funds, and various other legal files relevant to estate preparation. The Uniform Probate Code can differ by state, yet these laws govern different facets of estate planning and probates, such as the production of the depend on or the legal legitimacy of wills.

It is a difficult inquiry, and there is no simple solution. You can make some considerations to assist make the choice less complicated. When you have a list, you can narrow down your alternatives.

It entails deciding how your belongings will be dispersed and that will manage your experiences if you can no more do so on your own. Estate preparation is an essential component of monetary preparation and need to be done with the assistance of a certified professional. There are a number of aspects to think about when estate preparation, including your age, wellness, economic scenario, and family members situation.

Some Of Estate Planning Attorney

If you are look at these guys young and have couple of ownerships, you may not require to do much estate preparation. Nevertheless, if you are older and have a lot more valuables, you should take into consideration dispersing your properties among your successors. Health and wellness: It is a Check Out Your URL vital aspect to think about when estate preparation. If you are in good wellness, you might not need to do much estate preparation.

If you are married, you need to consider exactly how your properties will be distributed between your partner and your successors. It aims to guarantee that your properties are dispersed the way you want them to be after you die. It includes taking into consideration any type of tax obligations that might need to be paid on your estate.

4 Simple Techniques For Estate Planning Attorney

The attorney additionally assists the individuals and family members create a will. The lawyer also aids the people and family members with their depends on.